Hi,

I have tried loads of my own EA ideas, buying "commercial" EA's, spent thousands of hours analysing indicators all with the net result of losing about £50k. So my simple question is this - Do any of you out there make any money at all from your EA's?

hi, here is my 0.02

As a rule of thumb you can accept that if anybody would have a strategy that works __for sure__ and delivers say >10% of gain/month, he would be foolish to sell it as he would kill the cash cow. (every strategy degrades if there is too large amount of capital behind it).

If I would have a strategy that brings a couple of pcnts/month, I would be happy to sell it because revenue from selling would exceed profits of running the EA on my capital and I would not mind that the strategy will degrade if too much capital accumulates behind it because it would hurt others, not me... (you can infer that a real working strategy that is sold will be guaranteed to not work sooner-or later if sold to enough ppl - this all applies to technical analysis EAs. If there would be some EA that does fundamental analysis, that could work, but I doubt there is such, it is difficult even for investors..)

Just to give you some examples how some strategy sellers usually try to scam customers:

- it is relatively easy to build a strategy that is by high probability successful on the short term. For example the well known exponential method:

1) bet on a stock/fx/anything with quantity of 1 that has a target price of usd1 profit and a sl of usd1 loss

2) if you hit the SL, double the quantity (so tp/sl will give you +-2 usds) and go back to 1). If you win, go back to 1) with quantity of 1.

assuming that the chances of hitting the sl and the tp are both 1/2, you have a chance of 1/1024 to hit 10 SLs in a row, so if you start the portfolio with enough capital to cover this scenarion, you will have a perfectly linear portfolio gain, with not more than 10 SL deep dips... Until you are unfortunate enough to run into a 11 in a row SL (1/2048), where the dip would be 2x deeper than for a 10 long SL row, so it will possibly kick your account into negative.. Before this event the portfolio would show mor or less steady gowth, specifically (if you calculate it), it guarantees a 1 USD profit for every round of sl-sl-sl-sl-tp, so on average, your portfolio will rise by 2048 USDs before hitting the 11 SL in a row scenario. The loss of this 11 SL is: 1+2+4+8+16+32+64+128+256+512+1024+2048=4095=2048+2047, so it would bring down your profit to -2047... I frequently see advertised EAs with steady growth then going to steady ----- in a quick move. Those are probably similar scams...

you can then create lets say 10 of these strategies and run them in parallel, wait for a month and start selling the best looking one as an impressive strategy with real performance charts and throw the other 9 away...

you can see that it is quite easy to scam ..

- another popular method is to keep the negative trades open, thus accumulating a large floating loss. This is useful because there are sites where the performance graphs only show the balance, ths flating losses are not included...

There are other ways to scam others with strategies, I don't want to give ideas. The mos simple one is to create a website with false claims and sell it with money back guarantee...

How you could avoid being scammed: look for strategies that have a long verified history (long: both time and trades), look for suspicious spikes in the graph, if the trading history is available, look for doubling, tripling lots/sl/tp values. Look for floating losses! Look for 3rd party verification graphs where the equity (balance +- losses/wins) is also charted and where the equity curve is shown between trades, too, not only at the time of trades (an MT4 backtest fails this requirement). Ask the strategy provider to explain how they are handling risk management.. (of corse they can lie)

All the above does not mean that there could be no successful EAs, as there are. I am running my own (which is so far ok), but I am aware of the risks. You should not just buy and blindly trust a black box ea, you should be aware of the working internals, the risks, so look for free (or at least open source) eas and try to build your own from those. That is the way to success. You have to do market analysis before you try to make an EA. Newer believe a strategy that was developed on a backtest and was not forward tested (except for special cases where you can know for sure the max loss and take the risk).

hi, here is my 0.02

As a rule of thumb you can accept that if anybody would have a strategy that works __for sure__ and delivers say >10% of gain/month, he would be foolish to sell it as he would kill the cash cow. (every strategy degrades if there is too large amount of capital behind it).

If I would have a strategy that brings a couple of pcnts/month, I would be happy to sell it because revenue from selling would exceed profits of running the EA on my capital and I would not mind that the strategy will degrade if too much capital accumulates behind it because it would hurt others, not me... (you can infer that a real working strategy that is sold will be guaranteed to not work sooner-or later if sold to enough ppl - this all applies to technical analysis EAs. If there would be some EA that does fundamental analysis, that could work, but I doubt there is such, it is difficult even for investors..)

I think you know a lot about scams, I don't know from which side ;-)

Can you explain why "every strategy degrades if there is too large amount of capital behind it" ? It's not obvious, though I have often heard this kind of reasoning.

Martingale method which you describe is not necessarily scam. It's very risky, but if customer known what he buy and what he do, that can be profitable to SHORT term.

To answer the main question, I think it is quite possible to have a robot that is profitable in the short term (a few months). By cons in the long term I do not know, probably by modifying it regularly, then yes, if not maybe.

Anyway I don't think you can earn money on forex if you can't trade manually and understand all the ins and outs.

I think you know a lot about scams, I don't know from which side ;-)

Can you explain why "every strategy degrades if there is too large amount of capital behind it" ? It's not obvious, though I have often heard this kind of reasoning.

Martingale method which you describe is not necessarily scam. It's very risky, but if customer known what he buy and what he do, that can be profitable to SHORT term.

To answer the main question, I think it is quite possible to have a robot that is profitable in the short term (a few months). By cons in the long term I do not know, probably by modifying it regularly, then yes, if not maybe.

Anyway I don't think you can earn money on forex if you can't trade manually and understand all the ins and outs.

I don't think I am on the wrong side, as I encouraged him not to blindly buy anything, instead of look t freely available things and put something together on his own :)

The schemes explained are not scams by default, but when you sell a strategy claiming constant profits etc, without mentioning that it is a roulette strategy, well, that is scam. By the way, I would not use the mentioned exponential strategy even for the short term, there is no guarantee that there wont be an 11 in a row SL hit until trade 2048. That is only the expected value... You can be bankrupt with the first 11 trade if you are not lucky..

Why will every strategy (except for fundamental investment) will fail if there is too much capital? It is easy. In every strategy you will have to buy and sell positions. It is a market, so price moves on demand... If you are trying to sell 1000 lots in one trade, slippage is guaranteed and will be high. The idea behind the statement is that if there were a well known strategy which works and is used by many ppl, the capital behind it would grow to such high levels that it would change the market by itself. When the strategy would say buy, the market would rise (temporarily) so only the early birds profit (that is why ppl want the fastest execution possible). If there were such a strategy, the optimal strategy would be to buy the stock minutes before the signal and sell them to the strategy users who drive up the market... Actually there is a scam schame that builds on this: probably you have heard of email stock pick scams.. The recipie:

grab a couple of 1000 emails, on the first day send one half that a penny stock will go up, the other half that it will go down. If the stock went up, repeat the procedure with the email adresses that were in the "up" group. repeat this a couple of times. If you started with 1000000 email addresses, after 10 trades you will have 1000 users that think you are giving them the perfect strategy (remember, you told them where the stocks will move in advance.. you have also told that to other 999000 ppl and you were wrong but that 1000 see as if you were right)... Next pick a low volume penny stock, buy yourself in, announce in a mail to the 1000 users that you will soon have the greatest pick of all times, make them prepare. Then announce the stock, they will drive the price up, and you sell the stocks on the high... Here you see how the publicly known "optimal strategy" can be exploited for arbitrage.

By the way I think your last statement is not valid. I have only lost money while trading because of my emotional nature. I have managed to recover my losses by turning my trading ideas to an EA and running it. I encourage everyone who have good insights but can't trade by nature to do this (as long as you can clearly define ho your strategy would look like). But always lay the foundations of your ea on some fundamental basis, and frequently review wether your assumptions still hold or not (like yen weakening ). And yes, strategies, parameters, everything need frequent review. Machine learning probably could be used to keep EA's profitable but i am not an expert. I would appreciate any hints on this topic, where to look, where to start at. In theory this is what signal providers are supposed to do but when you look at most of the strategies on different sites, you will see that there are a few which is successful on the long term, yet you will see 100s of filed strats popping up daily. This makes me wonder how long the goods will last.. So be suspicious, but also remember that there can be profitable public strategies but not in the 10%/mo range on the long run (actually there can be as long as noone knows about it, only you : ).

Guys guys,

My question does not specifically refer to commercial EA's, but to EA's in general. Has anyone ever built an EA themselves that is profitable because after such a long time of trying I have not been able to do so.

Guys guys,

My question does not specifically refer to commercial EA's, but to EA's in general. Has anyone ever built an EA themselves that is profitable because after such a long time of trying I have not been able to do so.

Yes, it is possible, as I said I have mine so I am speaking from experience. The only reason I dare to run it on a live account is that it a no loss strategy (what a funny name) that relies on a strong market distortion and I can precisely calculate the max loss if the assumption breaks (yes a no loss strategy can lose and when it loses,it loses big) which is about 3-4 month's yield and I expect the underlying market distortion to last for more than 3-4 months. If this assumption will hold, the risk/reward ratio will fall to 0 after a couple of months of starting the EA. But as you see, there is an assumption here, that some specific market conditions wont change. This strat would have worked for > 1 year, unfortunately I started to use only 2 months ago and I already had to adjust some parameters 2 times (because of some market condition changes). I will be very upset if the underlying market condition will change because so far this is the only profitabe EA I was able to make...

So the basics: look for market distortions, analyze the strength and likely timeframe of the distortion, build test EA, investigate probable profit, limit max losses to something that i smaller than the probable yield during expected lifetime of the arbitrage opportunity. I think that to be successful, developers should form small closed groups (virtual trader roooms) and develop their own eas without sharing with the outside world. If you know any such closed community I would happily join, too.

Remember: You have to watch your EA, there is no EA that will work for every market condition.

Yes, it is possible, as I said I have mine so I am speaking from experience. The only reason I dare to run it on a live account is that it a no loss strategy (what a funny name) that relies on a strong market distortion and I can precisely calculate the max loss if the assumption breaks (yes a no loss strategy can lose and when it loses,it loses big) which is about 3-4 month's yield and I expect the underlying market distortion to last for more than 3-4 months. If this assumption will hold, the risk/reward ratio will fall to 0 after a couple of months of starting the EA. But as you see, there is an assumption here, that some specific market conditions wont change. This strat would have worked for > 1 year, unfortunately I started to use only 2 months ago and I already had to adjust some parameters 2 times (because of some market condition changes). I will be very upset if the underlying market condition will change because so far this is the only profitabe EA I was able to make...

So the basics: look for market distortions, analyze the strength and likely timeframe of the distortion, build test EA, investigate probable profit, limit max losses to something that i smaller than the probable yield during expected lifetime of the arbitrage opportunity. I think that to be successful, developers should form small closed groups (virtual trader roooms) and develop their own eas without sharing with the outside world. If you know any such closed community I would happily join, too.

Remember: You have to watch your EA, there is no EA that will work for every market condition.

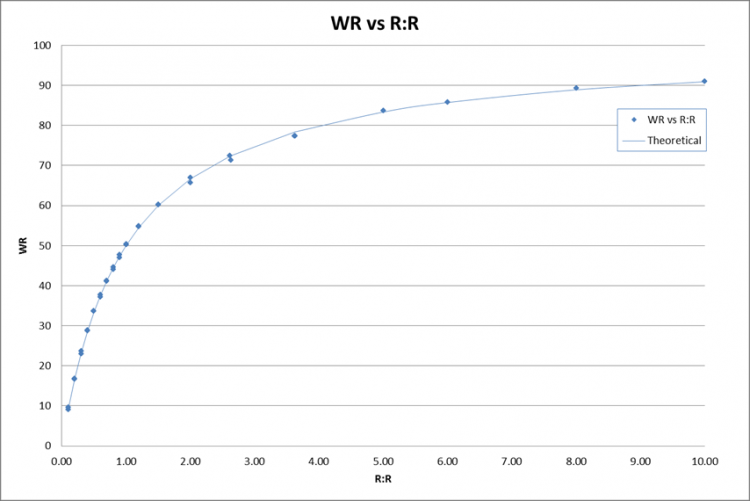

It sounds like you are simply using a very large risk and small reward which will inherently give a large win rate . . . but if the WR is simply a function of the R:R then it will also lose just the same way a coin toss does, it will just give you more winning trades while you wait for the infrequent but very large losing trade to come along.

Does your strategy lie on this curve ?

Hi,

I have tried loads of my own EA ideas, buying "commercial" EA's, spent thousands of hours analysing indicators all with the net result of losing about £50k. So my simple question is this - Do any of you out there make any money at all from your EA's?

Yes...Brokers and Banks :)

Hi,

I have tried loads of my own EA ideas, buying "commercial" EA's, spent thousands of hours analysing indicators all with the net result of losing about £50k. So my simple question is this - Do any of you out there make any money at all from your EA's?

I never recommend to use other's indicators. Instead I developed my own for my own use. The advantage is that I know how it works and which indications are trade-able. Here is one snapshot of latest SILVER chart for you. Of course, it makes money for me.

It sounds like you are simply using a very large risk and small reward which will inherently give a large win rate . . . but if the WR is simply a function of the R:R then it will also lose just the same way a coin toss does, it will just give you more winning trades while you wait for the infrequent but very large losing trade to come along.

Does your strategy lie on this curve ?

Hey mpeter : That is a great idea to form a private virtual group. Great way of sharing ideas and code where people can help take one another to the next level. Thus far I have been working by myself which is probably the reason for my dismal success rate. Though I am able to do most of the coding myself, collaboration would more likely bring a better success rate. I certainly would be willing to try this out. We can create a private forum, tabulate a bunch of ideas, narrow down to ones that people think are most promising. Then people go off and try out a bunch of strategies themselves and share results.

My day job is in engineering and I have long recognised that the more ideas I bounce off people out there, the more feedback I receive that can mutually take us all to success.

I never recommend to use other's indicators. Instead I developed my own for my own use. The advantage is that I know how it works and which indications are trade-able. Here is one snapshot of latest SILVER chart for you. Of course, it makes money for me.

Hey raghu,

Your indicator looks great, and yes I think you are on the right track by creating your own custom indicator. Its easier to know what to tweak and also a great feeling to know that you developed it yourself.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi,

I have tried loads of my own EA ideas, buying "commercial" EA's, spent thousands of hours analysing indicators all with the net result of losing about £50k. So my simple question is this - Do any of you out there make any money at all from your EA's?